When it comes to evaluating a company’s financial health, one of the most important metrics that investors look at is Earnings Per Share (EPS). EPS not only reflects a company’s profitability but also plays a major role in determining its stock price and investor confidence.

In this article, we will break down what EPS is, why it matters, and how to calculate it step by step with practical examples. By the end, you will have a solid understanding of this key financial concept.

What is Earnings Per Share (EPS)?

Earnings Per Share, commonly referred to as EPS, is a financial ratio that measures how much profit is allocated to each outstanding share of common stock.

In simple terms:

EPS = Profit per share available to shareholders.

For example, if a company earns $1 million in net income and has 500,000 shares outstanding, the EPS would be:

EPS = $1,000,000 ÷ 500,000 = $2 per share

This means every share of the company represents $2 worth of profit.

Why is EPS Important?

EPS is a widely used metric in stock market analysis because:

- Indicator of Profitability – It shows how much money a company is making for each share.

- Investment Decision Tool – Investors use EPS to compare different companies in the same sector.

- Valuation Metric – EPS is often used in valuation ratios like Price to Earnings (P/E ratio).

- Performance Tracking – It helps measure whether a company is growing or declining over time.

- Market Impact – Higher EPS usually leads to higher stock prices, boosting investor confidence.

Types of EPS

Not all EPS calculations are the same. Companies report EPS in different ways to give investors a clearer picture.

1. Basic EPS

This is the simplest form of EPS, calculated as:

Basic EPS = (Net Income – Preferred Dividends) ÷ Weighted Average Shares Outstanding

2. Diluted EPS

This includes the impact of potential shares from stock options, convertible bonds, or warrants.

Formula:

Diluted EPS = (Net Income – Preferred Dividends) ÷ (Weighted Average Shares Outstanding + Dilutive Shares)

3. Adjusted EPS

This version removes one-time expenses or income, giving a clearer view of recurring profits.

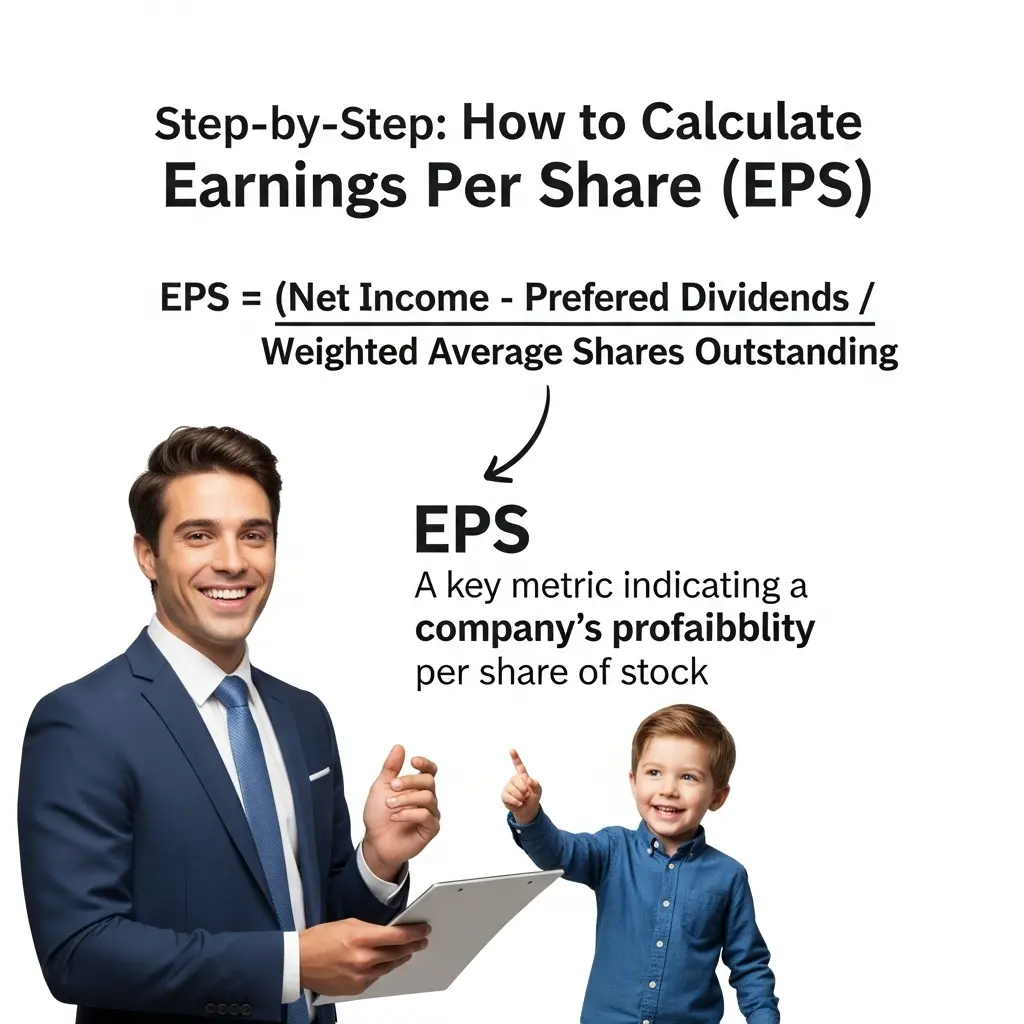

How to Calculate Earnings Per Share

Step-by-Step: How to Calculate Earnings Per Share

Let’s go through the calculation in detail.

Step 1: Find Net Income

Look at the company’s income statement. The net income is the profit after all expenses, interest, and taxes.

Example:

Net Income = $5,000,000

Step 2: Subtract Preferred Dividends

If the company pays dividends on preferred stock, subtract them since EPS is for common shareholders.

Example:

Preferred Dividends = $500,000

Adjusted Net Income = $5,000,000 – $500,000 = $4,500,000

Step 3: Determine Weighted Average Shares Outstanding

Companies issue or buy back shares throughout the year, so we use the weighted average.

Example:

Shares outstanding = 1,500,000

Step 4: Apply Formula

EPS = (Net Income – Preferred Dividends) ÷ Weighted Average Shares Outstanding

EPS = $4,500,000 ÷ 1,500,000 = $3.00 per share

Practical Example of EPS Calculation

Imagine ABC Ltd. has the following data:

- Net Income: $12,000,000

- Preferred Dividends: $2,000,000

- Weighted Average Shares: 4,000,000

EPS = (12,000,000 – 2,000,000) ÷ 4,000,000

EPS = $10,000,000 ÷ 4,000,000 = $2.50 per share

This means for every share held by a shareholder, the company generated $2.50 in profit during that period.

https://www.investopedia.com/terms/e/eps.asp

Basic EPS vs. Diluted EPS Example

Let’s expand on the same company ABC Ltd.

- Net Income = $12,000,000

- Preferred Dividends = $2,000,000

- Weighted Average Shares = 4,000,000

- Stock Options (potentially convertible) = 500,000

Basic EPS = ($12,000,000 – $2,000,000) ÷ 4,000,000 = $2.50

Diluted EPS = ($12,000,000 – $2,000,000) ÷ (4,000,000 + 500,000)

= $10,000,000 ÷ 4,500,000 = $2.22

Notice how diluted EPS is lower because it accounts for additional potential shares.

EPS and Price-to-Earnings (P/E) Ratio

EPS is often used along with the P/E ratio, which tells investors how much they’re paying for $1 of a company’s earnings.

P/E Ratio = Share Price ÷ EPS

Example:

- Share Price = $50

- EPS = $2.50

P/E Ratio = 50 ÷ 2.50 = 20

This means investors are willing to pay 20 times the company’s earnings per share.

Limitations of EPS

While EPS is useful, it has some limitations:

- Doesn’t Reflect Cash Flow – EPS is based on accounting profits, not actual cash.

- Earnings Manipulation – Companies can use accounting tricks to inflate EPS.

- Ignores Debt – EPS does not reflect a company’s financial risk.

- Not Comparable Across Industries – A high EPS in one industry might be average in another.

How Investors Use EPS in Decision Making

EPS plays a huge role in investment strategies. Here’s how investors use it:

- Growth Investors look for companies with increasing EPS year after year.

- Value Investors compare EPS with stock price to find undervalued stocks.

- Dividend Investors analyze EPS to see if profits can support future dividends.

- Analysts track EPS against forecasts. If EPS beats expectations, stock prices often rise.

EPS Growth Rate

Another important concept is the EPS growth rate, which measures how quickly a company’s earnings are increasing.

EPS Growth Rate = (Current EPS – Previous EPS) ÷ Previous EPS × 100

Example:

- Last year EPS = $2.00

- This year EPS = $2.50

Growth Rate = (2.50 – 2.00) ÷ 2.00 × 100 = 25%

This indicates strong financial performance.

EPS in Real-World Stock Market

- Apple (AAPL) consistently reports growing EPS, which contributes to its high valuation.

- Tesla (TSLA) had negative EPS for years until it turned profitable, changing investor perception.

- Amazon (AMZN) had low EPS for years because it reinvested profits, yet its stock price grew due to future growth potential.

Tips for Investors When Using EPS

- Always check both Basic and Diluted EPS.

- Compare EPS with industry peers.

- Look at trends over several years, not just one quarter.

- Combine EPS with other metrics like Revenue Growth, ROE, and Debt Levels.

- Be cautious of companies with sudden EPS spikes – it might be due to one-time events.

Conclusion

Earnings Per Share (EPS) is one of the most essential tools for evaluating a company’s profitability and investment potential. By learning how to calculate EPS, understanding its variations, and knowing its limitations, investors can make smarter and more informed decisions.

To recap:

- EPS Formula = (Net Income – Preferred Dividends) ÷ Weighted Average Shares Outstanding

- EPS helps investors compare profitability across companies.

- Always check both Basic and Diluted EPS for a clearer picture.

- Combine EPS with other financial metrics for better analysis.

In short, EPS is a window into a company’s financial performance and a guiding light for investors aiming to build wealth in the stock market.

Q: What exactly does Earnings Per Share (EPS) mean?

A: EPS is a financial metric that shows how much profit a company earns for each outstanding share of its stock. It is calculated by dividing net income (after taxes and preferred dividends) by the number of outstanding shares.

Q: Why do investors and analysts care about EPS?

A: EPS is important because it indicates a company’s profitability and helps investors compare performance across companies. A higher EPS usually means the company is more profitable and attractive to investors.

Q: Can you give a simple EPS calculation example?

A: Yes. Suppose a company earns $10 million in net income and has 2 million outstanding shares.

EPS = $10,000,000 ÷ 2,000,000 = $5 per share.

Q: How is EPS connected to the P/E ratio?

A: The P/E ratio is calculated as Stock Price ÷ EPS. Investors use it to measure whether a stock is undervalued or overvalued compared to its earnings.